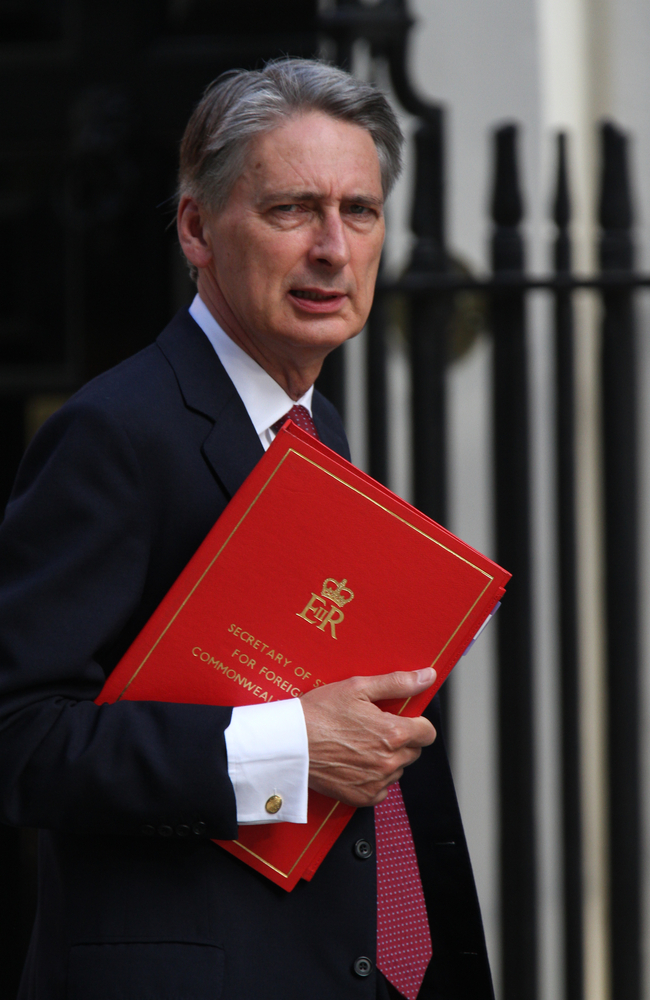

Chancellor Philip Hammond has abandoned proposed rises to national insurance, less than a week after the unveiling of his last spring budget after bowing to party pressure.

In a formal letter to his fellow Tory MP’s Mr Hammond wrote:

“It is very important both to me and to the prime minister that we are compliant not just with the letter, but also the spirit of the commitments that were made.

“In the light of what has emerged as a clear view among colleagues and a significant section of the public, I have decided not to proceed with the Class 4 NIC measure set out in the Budget.”

According to the proposal, the treasury intended to initially raise National Insurance contributions for those classified as self-employed from 1 percent to 10 percent, with a envisaged further increase to 11 percent in 2019 to reflect the current 12 percent paid by employees. The provision had been initially introduced as a way to “reflect more fairly the differences in entitlement” between employed and self-employed individuals. Despite the decision, Mr Hammond mantained in the letter that the Government considered this to be the “right approach”.

Prime Minister May told the Commons of the decision:

“We made a commitment not to raise tax and measures we put forward in the Budget last week were consistent with those [tax locks]. As a number of my Parliamentary colleagues have pointed out in recent days the trend towards greater self-employment does create a structural issue within the tax base on which we will have to act. We have to maintain fairness within the tax system.”

Conservative back-benchers have criticised the move for breaking with the party’s 2015 Manifesto pledge not to raise national insurance, income taxes or VAT. Crucially, the current May Government remains un-elected, and thus derives some of its mandate to govern from the manifesto that the Conservatives were initially elected on in 2015. Nevertheless, the U-turn presents a dilemma for the Treasury, as it wipes around £2billion from the budget.