Oil markets will continue to be flooded with excess oil for the first half of 2017, according to the latest update by the International Energy Agency.

Supply is expected to outpace demand into the second half of next year as a slowdown in demand fails to offset a slowdown in production.

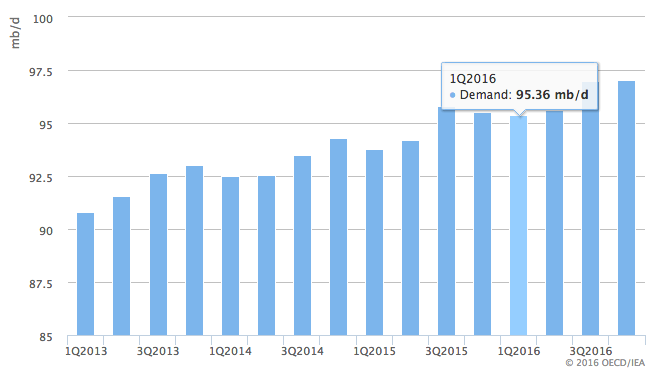

In the report, the International Energy Agency said global oil demand is growing at a faster pace than expected with again of 1.3 mb/d expected in 2016. However, this figure represents a downgrade of 0.1 mb/d on the previous forecast after a slowdown in the third quarter.

“Even with a modest weather-related uptick forecast for the end of the year, oil demand growth in 2016 will struggle to get above 1.3mb/d,” said the report.

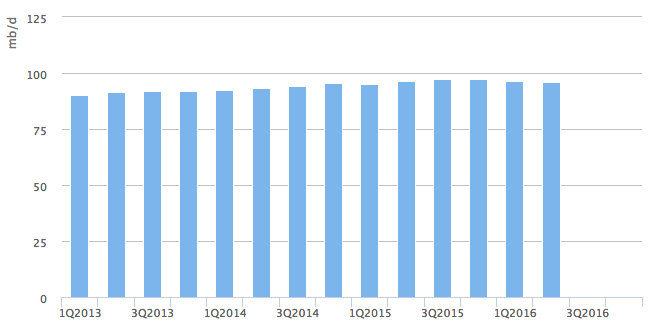

Global supplies of oil fell in August, despite OPEC countries continuing to produce a near-record amount. Steep declines in the production of non-OPEC countries partially offset the excess supply.

Middle East producers continued to flood the markets, particularly Iran, who begun putting oil on the market earlier this year in the wake of having sanctions against them lifted. Iran have been a major barrier to an agreement to freeze oil production in OPEC countries.

The IEA report cited a lack of demand as the reason for the continuing oil glut, saying:

“Recent pillars of demand growth China and India are wobbling. After more than a year with oil hovering around $50/bbl, the stimulus from cheaper fuel is fading. Economic worries in developing countries haven’t helped either. Unexpected gains in Europe have vanished, while momentum in the US has slowed dramatically.”

Looking to the future, the International Energy Agency said:

“With the price of oil at current levels, one would expect supply to contract and demand to grow strongly. However, the opposite now seems to be happening. Demand growth is slowing and supply is rising. Consequently, stocks of oil in OECD countries are swelling to levels never seen before.”

Oil prices fell on the news today, with WTI Crude down 2.4 percent at $45.18 a barrel and Brent Crude down 2.05 percent $47.33.